Sales Compensation Plan for a Distribution Company

A comprehensive guideline

Sales are the main driver of every organization. That is why in previous articles I have talked about how a distributor can increase sales in the store. Therefore, it is very important to get on board and retain the best sales reps. But, at the same time, you want your sales reps to be motivated to sell as much as possible. The best way to do this is with a well-devised sales compensation plan. In this article, I will give all the elements you need to design your sales rep compensation plan.

Sales structure of a distribution company

Any company that manufactures products or provides services or represents a brand has to talk their customers into buying their products through a conventional sales process of lead development, sales presentation, follow-up, and closing. The sales structure that supports this process is usually role-based, with a different profile for each step.

The sales process of Distribution and Direct Store Delivery companies is different because the sale is made in the store. There is no lead generation, just the Sales Rep face-to-face with the store manager. In its basic form, the figure below illustrates the structure.

For larger distributors, there might be district managers who control a region´s Sales Reps and Sales Managers.

Sales models of a distribution company

Basically, there are three ways that distributors manage the sales and delivery force.

- Sales Rep as employees

- Independent Contractor Model

- Sales Reps as employees and truckers as independent contractors

Sales Rep as employees

In this model, sales reps and drivers are company employees with full payroll benefits. This model has the highest cost for the company but gives you total control of the sales and fulfillment operation.

Independent Contractor Model

In this model, the sales rep and the trucker are the same people and are responsible for the sales in the stores and the vehicle to deliver the sales. The company provides technical training on products, establishes sales goals, assigns sales routes, and provides financial assistance for the truck acquisition, if necessary.

This model has the lowest selling costs for the company since they do not have the payroll tax expense (7.65% plus 1.7%-3.4% for the state unemployment tax). It also carries the least risk to the company, as the sales rep/driver is responsible for the truck and liable for any accidents.

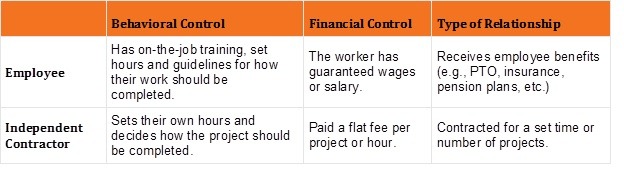

The main disadvantage of this model is that the company loses control of the sales process. You can mitigate this by setting goals, tracking field visits, and designing payment terms that reinforce your priorities. But you must be very careful about this, as many states, Florida among them, consider an independent contractor as an employee if the company controls their activities. For reference, below are the criteria used by the IRS to differentiate an employee from a contractor.

Sales Reps as employees and truckers as independent contractors

In this model, the sales reps are employees but the drivers are independent contractors. With this model, you have the advantage of fully controlling the sales process, and limiting transportation costs and risks.

Components of a sales compensation plan

A sales compensation plan defines how you’re going to pay your sales reps for their contribution to the sales and gross profits of your business. A well-conceived compensation plan can boost the performance of your sales team and increase your revenue. It is usually made up of five elements:

Base salary (if you are an employee) or minimum pay (if you are an independent contractor): This is a fixed monthly amount that you pay to your sales reps. It can be paid weekly or twice a month. The amount varies depending on the profile and experience of the sales rep, the strength of the portfolio, and the maturity of the territory. For example, it is not the same to have a portfolio with well-known brands such as Coca-Cola or Nestlé, than one with new brands; Similarly, it is different if the sales rep is given a developed zone than a new one. For unfamiliar products or new zones, you will probably have to give a higher sales/commission ratio if you want to get a good sales rep.

Commission on sales: it is a variable amount that you pay based on the monthly sales made by each sales rep. There are two ways to structure the sales commission.

- Pay a flat % for the sales

- Pay based on a scale: for example, 50% of expected sales volume or quota has a P1% commission. From 51% to 75% of the quota, the commission is P2%, and so on. The intent is to motivate sales reps to sell as much as they can and to differentiate high achievers from underperformers.

You may choose to pay based on sales or pay based on sale collection.

Bonuses or incentives for special achievements: It is a fact that the more you sell, the better your gross profit. Unlike commissions, bonuses are not a percentage of your total sales. Instead, they are an additional sum of money that you pay your sales reps to achieve specific sales or business goals. The rationale for this component of sales compensation is to encourage sales reps to go beyond their quota and support the company at certain events. Here are some examples.

- An additional % if the sales quota is exceeded. Can be flat or in scales.

- A bonus for selling new products in a store

- A bonus if the sales rep opens a new store

- A bonus for selling items in special promotions that will reduce company losses or result in more future sales. A typical example of the former is when you have products with a short expiration date. A new product line is a typical case of the latter.

Benefits: This category includes any benefits that you offer to your employees that will reduce their off-the-pocket expenses but increase your cost of sales. Benefits are usually offered as a way to attract and retain qualified personnel. When offered, it applies not only to sales reps but to all employees; so, it carries an additional level of expenditure on human resources. Only long-established distributors with a high sales record consider this component. For new distributors, the costs of these programs are prohibitive. Here are some examples:

- Gas allowance, tolls, and any vehicle-related payment.

- Cell phone data plans

- Health insurance

- 401K

- Leave days

- Vacation bonus

Demerits: All of the previous components add up to the sales rep’s income. But there are events under the sales rep’s control, which might result in the return of merchandise and even the loss of customers. These are some of the cases.

- Products returned because they expired on the shelf or in the store warehouse.

- Damaged products

- Promotional products that did not sell

In all of these events, the sales rep had been paid for the sales of the returned products, so the common practice is to deduct the commission paid for the returned items.

Clawbacks is another type of demerit but it does not apply to DSD and distribution companies.

Basis of a sales compensation plan

The source of capital to pay for a compensation plan comes from gross profit from sales. Therefore, you need to be aware of your expected sales and their impact on the gross profit before setting values. Below I present an extract of common practices applied by existing distributors regarding the components of the sales compensation plan. This information is based on personal experience, a survey conducted by recruiting sites, and a survey made by Sanitary Maintenance magazine.

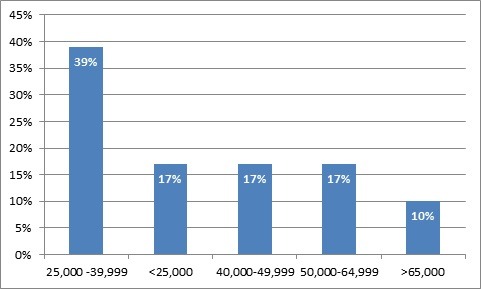

Total yearly pay: The first thing you need to define is the total yearly income that you will pay to sales reps. The graph below shows the average yearly income of a sales rep. Many variables affect the level: experience, level of study, the volume of customers per rep, and total company sales, among others.

Base Salary and Sales Commission: Once you have defined your baseline, you have to decide what proportion of that will be salary and what will be variable. Here are some practices.

- Nearly 50% of distributors pay their vendors a salary based entirely on commissions. 45% pay a combination of base salary plus commission. Only those new to the market pay a fixed salary.

- Inexperienced sales reps typically have a term with only a base salary. During that period, all outstanding credits from the previous vendor must be taken. After that period, the sales rep is switched to the regular sales compensation plan.

- Over 50% of salary plus commission distributors use a 30-70 salary-to-commission ratio.

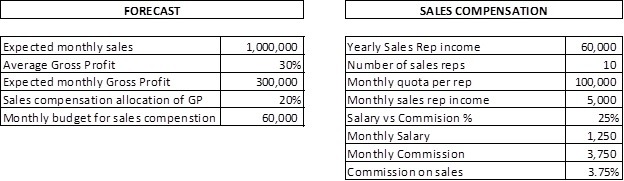

The total cost of the sales structure: The next thing to do is determine how much of the gross profit you are willing to allocate to the sales structure. The figure you come on with is based on your forecast and the rationale is that once you exceed the forecast sales, the actual allocation will start to decline, thus increasing your real gross profit. Here are some references.

- 83% of the publicly traded distributors are paying a percentage of gross profit for each item sold. The other 17 percent pay a percentage of gross sales. The main drawback of this method in privately held companies is that the gross profit is a value that comes from applications not visible to the sales rep.

- Most private distributors pay commission based on net sales less credits.

- 50% of distributors allocate 26% to 35% of gross profit to configure the sales reps compensation plan.

The figure below is an example of how to define the variables for the plan and the plan itself. A distributor forecasting $1 million per month, with an average gross profit of 30% and a sales compensation budget equal to 20% of gross profit, can allocate $60,000 per month to compensate sales reps. Assuming a force of 10 sales reps, which means a sales quota of $100,000 per month per rep, the expected monthly salary per sales rep would be $5,000. With a 25-75 sales/commission relationship, the base salary would be $1,250 per month and a 3.75% commission on sales.

If you adopt the full commission salary model, the commission on sales would be 5%. And if you go with sales reps as independent contractors, you can add your payroll tax savings to that commission, leaving it at 15% on sales. As you can see, there are many combinations that you can do. For example, set a commission scale based on meeting the quota.

I hope this article had been helpful. I will continue to post information related to Warehouse Management, distribution practices and trends, and the general economy. If you are interested in this article or would like to learn more about Laceup Solutions, please sign up to stay updated on future articles.

You can also watch this video related to sales compensation

Sorry, the comment form is closed at this time.