5 things Sam’s Club is doing to top Costco and changing the paradigm of warehouse clubs

In our article “What is the best way to get your product in stores?” we explained the different types of grocery retailers. Warehouse clubs are one of them. Three stores compete in the US in this segment: Sam’s Club, Costco, and BJ’s Wholesale also known as the Big Three, with Costco having the leadership in terms of revenues, profit, and coverage. However, we have mentioned several times that the changes that the distribution and retail industry have undergone in the last two years are forcing companies to challenge the traditional business model. This is precisely what Sam’s Club has been doing.

In this article, I explain what the traditional business model of warehouse clubs is, how Sam’s and Costco compare, and what Sam’s strategy is to challenge Costco’s leadership.

Warehouse clubs business model

The Big Three business model is very much the same. The warehouse club business model seeks to limit gross profits to offer low prices to members while generating profit for shareholders through reasonable membership dues. Its main features are:

- Warehouse clubs sell paid memberships to consumers and small business customers that provide access to a wide selection of goods, often in bulk, at reduced prices in large-store formats.

- Grocery products are a major driver of foot traffic, but shoppers can purchase everything from apparel to appliances, seasonal goods to eyeglasses, and even fill up the car’s tank, at warehouse clubs.

- At the heart of the warehouse club business model are memberships and economies of scale.

- The clubs’ large membership base enables them to purchase items from suppliers in large volumes at low cost, which, in turn, helps them attract more members.

- Warehouse clubs can price products at a fair markup to cover costs and operating expenses. If the membership is high, they might take that income as the main source of profit.

Main Sam’s and Costco indices

To understand the action plan set up by Sam’s Club, we need to understand the context of both companies. The table below shows the main performance indices of both.

These are the highlights:

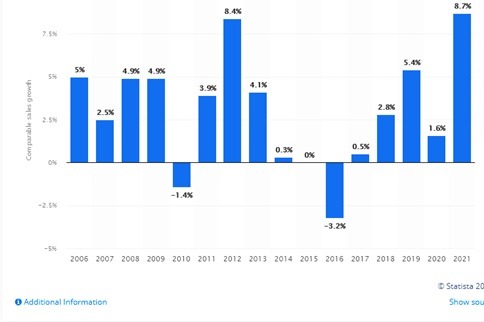

- Sales of Sam’s Club started to decline in 2013. They began to recover in 2018 and 2019 to fall again in 2020 to the point of closing 63 clubs. The growth that started in 2021 is part of the response to the new business model they are striving to implement. In contrast, Costco´s sales are stable, growing at an average of 9% per year.

- Although Sam’s Club has more stores and members than Costco, its net sales and gross profit are almost half that of Costco.

- Both clubs have an e-commerce channel with a similar contribution to net sales.

- Sam’s membership is less costly than Costco´s, but the benefits are very much alike, with the difference that Costco offers fuel service.

- They both have private labels, but Sam’s has more than Costco.

- The different surveys are not conclusive on customer satisfaction, but they all agree that return policies and payment methods are better at Costco.

Where was the problem?

Erratic sales behavior in recent years, and the fact that Costco’s sales and gross profit are considerably better than Sam’s despite having more members and stores, led them to search for the reasons for that. The conclusions were:

- Having members does not mean that they will be loyal. Many people have a membership card for more than one club.

- Stock depletion was a key issue for members dispersing their store visits

.

- Vendor relationships were one-sided, and Sam’s imposing conditions sometimes ignored the needs of their de facto partners. This was a big contributor to the out-of-stock and the disappearance of club products.

- Demos and tastings were passive in nature, generating insufficient sales to offset the burden on merchants and vendors.

- Digital interaction with vendors was done through a cumbersome portal that did not add significant value.

In analyzing these issues, Sam’s concluded that the traditional warehouse club model was at the root of their problems. Looking at the strategies implemented by the parent company, Walmart, they decided to change the culture and the way of doing business with the Clubs.

Sam’s Club strategy

The new model developed by Sam’s Club that is already showing results is based on a five-fold strategy.

- Merchants, suppliers, members, and corporations have to merge into a win-win model. They call this new App FUSION and it provides all the necessary sales information to optimize sales, such as sales by store, demographic data, etc.

- They have improved the supplier’s portal with a system called Madrid 2.0. This new portal has much more information than the previous one, very much in line with Walmart’s Retail Link. All vendors must register on this portal to remain vendors.

- They created a vendor application called Item Data Management (IDM) that provides merchandising personnel with all the information required to optimize product display.

- They have upgraded the demos and tasting experience to take them from a passive to a proactive experience. These are some of the actions:

- In the past, the demo personnel were the Club’s employers, like all other clubs. Under the new model, they share that responsibility with the vendors and the merchants who, after all, are the ones paying for that.

- There are “mobile tray” demonstrators that even come out of the store to offer the product. They also provide an App that allows customers to post reviews.

- They are implementing “digital demos” that are displayers that explain the benefits and promotions of the products.

- Three categories of promotional events have been created for suppliers: Macro events (four times a year), Micro events (determined by priorities and highly synchronized with suppliers), and supplier-led events (to be negotiated with suppliers).

I have said it many times and I never tire of repeating it: innovation and creativity are the new rules of the game in the distribution business.

I hope this article has been helpful. I will continue to post information related to Warehouse Management, distribution practices and trends, and the general economy. If you are interested in this article or would like to learn more about Laceup Solutions, please sign up to stay updated on future articles.

There is a lot of relevant information on our channel. Take a look at this video!

Sorry, the comment form is closed at this time.