How to plan a successful business exit strategy?

One of the things you should do when planning to start a business is what to do if you decide to step aside from it at some point in the future. According to data from the U.S. Bureau of Labor Statistics, 50% of new businesses fail within the first 5 years. Or maybe you would like to spend your senior years living a quality life with your family instead of working until you die. If any of this happens, you want to be prepared to exit ensuring the financial stability and continuity of the company. This is covered with a planning process called a business exit strategy.

In this article, I will explain what an exit strategy is, what events can trigger it, and things to consider when making your plan.

What is a business exit strategy?

A business exit strategy is an entrepreneur’s strategic plan for selling their ownership of a company. An exit strategy gives a business owner a way to reduce or liquidate his or her stake in a business, making a substantial profit, if the business was successful, or limiting the losses if the business was unsuccessful. A business exit strategy may also be used by an investor such as a venture capitalist to plan for a cash-out of an investment.

Triggers for executing an exit plan

There are many reasons why a business owner might decide to step off the company, but there are three main triggering events:

- The criteria established in the business exit strategy plan are met

- Owners get tired

- The business is no longer sustainable

Elements to consider to define the best exit strategy

There are three elements you need to consider before defining your exit strategy.

What are your Personal Goals?

Upon exiting the business, are you interested in making a profit, do you want to leave a legacy or both?

Exit Timeline

When do you intend to sell the business? Is the triggering event a date, such as your 60th birthday, or a milestone, like when the company reaches certain revenues and profits? When establishing this time frame, allow flexibility for more negotiating power. If the time frame is tight, the business sale might not go smoothly as everything will be done in a rush and stakeholders might not have enough time to make the business reach its full potential.

Business scope

The anticipated market size of your company´s product or service determines the size of the potential people interested in the business. This is a key element in choosing a strategy and developing the business plan of the company.

Exit strategy types

There are different paths you can take when designing your business exit strategy. What is best for you depends on the answer to the questions in the previous section. Depending on the answer, you might be prone to using one or the other exit method. Let’s go over the options.

Keep the business in the family

Many entrepreneurs want to keep their business in the family. This means making plans to transition the company to a child or other family member at a certain point in time. With this strategy, you keep the legacy in the family and accumulate successors over time. The key to the success of this strategy is the selection of a successor. If you choose the wrong person, you risk losing the internal support of partners and key employees and knocking down all the effort that went into building the company.

Sell the business to another company

In “How a Merger & Acquisition strategy can help grow your distribution business” we talk about acquisition as a way to grow your distribution. But an acquisition can also be an exit strategy. It happens if your company is purchased by a company with similar goals or aligned with your business. The main advantage of this strategy is that you can negotiate the sale price and the way to leave. The main problem that I have seen with this method is that selling a business is not easy; it might be time-consuming and according to different sources only 20% of the businesses listed for sale are actually bought. So, if that is your preferred strategy, choose an alternative just in case.

Sell your shares to a partner or investor

If you are not the sole owner of your business, it is possible to sell off just your stake to a business partner or other investor. This strategy is very common and the procedures to sell your shares are normally established in the company’s Bylaws. The main advantage of this strategy is that the trauma associated with your departure is very small since the business remains with known partners. The main con that I have seen in this method occurs if the partners are not interested or are not in a position to buy you out, since finding a suitable investor might take time.

Sell the business to one or a group of employees

When you are ready to exit your business, people who already work for you may want to buy the company. Because these people know you and know how to manage the organization, this business exit strategy normally results in a smoother transition and increases loyalty to your business’s legacy. This is one of the most used strategies as Plan B of the main strategy.

Making your company public with an IPO (Initial Public Offer)

This strategy is not common because IPOs are very complicated, costly, and time-consuming. Even if your business is booming, your industry may not appeal to the public in a way that gets stock buyers excited, thus devaluing your company. But if your company meets the criteria, this strategy can give you a huge profit.

Liquidate the company

Liquidation does not necessarily mean defeat but rather the end of a chapter. This exit strategy is the most final. By liquidating, you will be closing your business and selling your assets, and affecting employees and clients who relied on you. The cash resulting from the sale less the cash needed to pay off any debts and payout any shareholders will be your exit profit or loss.

Which one is my best exit option?

There are no guides that tell you which strategy to choose. Below I give you some general rules of thumb.

- A Legacy exit strategy calls for product or brand name development that will be profitable over time. The time needed to have profitable products or services is not relevant; They can be short or long term as long as they become cash cows and last a long time.

- A short time frame strategy implies short-term product development that generates value very quickly. Seasonal products or products related to timely events like the Olympics are examples of this type of product. Mass consumer technology products also fall in this category.

- A profit-based exit strategy will focus on building tangible and intangible value for maximum valuation. For example, if you are going to develop a distribution business, these are some of the decisions you have to make based on the exit strategy conceived.

- Buy a warehouse vs leasing. Owning the warehouse increases the asset value but increases the capital needs.

- Have your own fleet vs outsourcing the delivery. The former increases the asset value and will eventually translate into lower delivery costs, whereas the latter implies a lesser initial investment.

- Develop your own brands vs having product representation. Developing your brand is costly and takes time, but it will generate intangible asset value in the long run.

- Portfolio size and variety. The larger and more varied the portfolio, the more stable the source of revenues. But building this type of portfolio takes time and extends the time in which the investment is required.

- Target Markets: Independent stores are the first choice of short-term exit strategies. But if you have a long-term strategy, you can go for the supermarkets and limited-assortment stores.

- Exit strategy based on selling to third parties requires a clear definition of the KPIs to be used and the System to monitor the KPIs, as well as the type of ERP system

Exit Planning Process

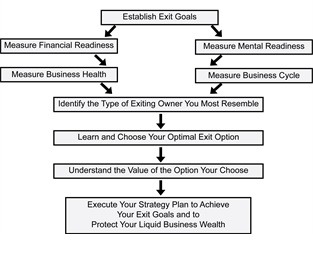

The figure below summarizes the exit planning process explained in this article.

I hope this article has been helpful. I will continue to publish information related to Warehouse Management, distribution practices and trends, and the general economy. If you are interested in this article or want to learn more about Laceup Solutions, register to keep you updated on future articles.

There is a lot of relevant information on our channel. Take a look at this video!

Sorry, the comment form is closed at this time.