Agile and resilient organizations case study. Deep dive into Sysco’s response to the pandemic

Sysco Corporation is the largest global distributor of food and related products to the food service or food-away-from-home industry, with restaurants accounting for more than 50% of its revenue. All sectors related to restaurants were severely affected by the 2020 pandemic. However, according to Sysco’s 10K report, they managed to minimize this impact by following the principles of agile and resilient organizations. In this article, I do a deep dive analysis to explain what Sysco did to address and overcome this contingency.

An overview of Sysco

Sysco Corporation was founded in 1969 and commenced operations as a public company in March 1970 when the stockholders of nine companies exchanged their stock for common shares of Sysco. They have grown from $115 million to $52.9 billion in annual sales. Their growth strategy is a combination of internal expansion of existing operations and planned acquisitions.

They have for operational units:

- US food service

- International food service

- U.S. Custom Distribution (SYGMA)

- Hotel supplies and others

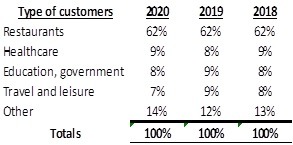

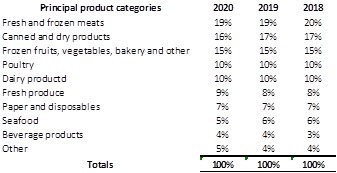

They have 4 main types of customers with a high dependency on restaurants which accounts for 62% of total sales. They operate in 9 well-balanced categories, without depending on anyone in particular.

They purchase from thousands of suppliers at a domestic and international level, none of which individually represents more than 10% of total purchases.

Effect of the pandemic on Sysco’s operations

In response to the COVID-19 pandemic, government authorities in many countries in which Sysco operates and in which their customers and suppliers also operate, imposed mandatory closures, sought voluntary closures, and imposed restrictions on travel, business operations, and public gatherings or interactions. These actions affected the operation of restaurants, schools, hotels, and cruise liners, which have negatively affected demand in the foodservice industry, including demand for Sysco’s products and services. Here are some figures.

- During the last couple of weeks of the third quarter of fiscal 2020, Sysco experienced declines in sales to most of its customers, except for certain customers in the healthcare segment. The decrease in sales from the US operations was 10.9%; for the international operation it was 15.8% and for the whole corporation it was 12% ($7 billion).

- The “exit rate” of their sales at the end of fiscal 2020 was a decline of approximately 30% compared to the end of fiscal 2019.

- The provision for receivables not collected rose from $28,176 million in 2019 to $334,810 million in 2020 due to the closure or diminished operations of restaurants and hospitality clients.

- Basic earnings per share in fiscal 2020 were $0.42, an 87.0% decrease from the comparable prior year period of $3.24 per share.

.

Talking about agile and resilient organizations

A crisis is a constant factor in any business. They can come from natural forces, international political issues, business-related reasons, and domestic economic policies. In previous articles, we have talked extensively about the importance of developing agile and resilient organizations. Sysco Corporation is a perfect example of how to do it and how to benefit from it. The way they built up their organizational structure, growth strategy, business model, and financial support, all have the principles of a resilient organization. Let’s take a look in the next section at how it did work for Sysco.

Key actions taken by Sysco

Since the food industry is considered an essential service, Sysco could continue to operate. Immediately after the onset of the crisis, Sysco took action to ensure liquidity, reduce variable and structural costs, and pivot the business to maximize sales during a period of disruption. These are the key elements of their “Reaction Plan”.

- Increase Liquidity:

They increased liquidity to more than $8.0 billion in cash and available liquidity through the use of financial mechanisms embedded in their structure:

- A $1.6 billion loan under a revolving line of credit.

- A $4 billion unsecured bond offering

- Establishment of a £600 million Bank of England commercial paper program, and

- A new line of credit of $750.0 million at 364-day.

This liquidity provided them with financial flexibility during this difficult operating environment and enabled them to invest in the business and transform the company to adapt to the crisis.

2. Stabilize the business by eliminating costs.

- They reduced expenses to match the lower level of sales, thus taking the right steps to manage costs during the downturn.

- They removed approximately $500 million of business expenses in the fourth quarter of fiscal 2020, reflecting, in part, the reduction in staffing levels through temporary workforce furloughs and permanent reductions in force.

3. New sources of revenue:

They created new sources of revenue from their existing restaurant customers. These include helping approximately 16,000 of their customers set up “pop-up shops” in their dining areas.

4. Assistance to Customers

They helped customers with reopening plans, such as patio and outdoor dining options and a shortened, more focused menu, as well as the technological capability to start a website. As part of this program, they helped customers connect with preferred delivery partners and set up take-out menus and other support for their “to go” offerings. The quick-service restaurant segment continues to thrive in the current environment, as the volume of “to go” and drive-through orders has gained steady momentum..

5. Emphasis in sanitary products:

They provided cleaning, sanitation, and personal protection products, without disruption, for their customers to continue business operations and increase sales in a category that, before the pandemic, was marginal.

6. Expansion of distribution channels:

Lastly, they shifted sales to serve the grocery retail channel. Before the COVID-19 pandemic, approximately 50% of food consumption within the U.S. occurred away from home, and the remainder had been taking place within the home. The COVID-19 pandemic has changed the balance and shifted more purchases to the retail grocery channel. Realizing that the new reality left idle capacity in the Distribution business unit, they pivoted the distribution model to include retail, grocer, and new supply chain partnerships, sectors that they did not serve before the COVID-19 crisis. This has created long-term relationships with smaller regional retail grocers, where they could add value through items such as quality proteins and fresh produce, where our buying advantage is helpful to them in the long term.

Effects of actions taken by Sysco

Sysco’s Q4 2021 report shows a considerable improvement in results, even though some of the effects of the pandemic still linger. The key financial accomplishments compared to 2020 were:

- Sales increased 82.0% versus the same period in the fiscal year 2020 and increased 4.3% versus the same period in the fiscal year 2019;

- Gross profit increased 86.2% to $2.9 billion, and gross margin increased 41 basis points to 18.1%, compared to the same period last year;

- Operating income increased 207.2% to $569.7 million, and adjusted operating income increased to $605.2 million, as compared to the same period last year;

- Earnings before interest, taxes, depreciation, and amortization (“EBITDA”) increased to $778.6 million, and adjusted EBITDA increased to $781.1 million, as compared to the same period last year;

- Earnings per share (“EPS”) increased to $0.29 compared to a loss per share of $1.22 in the same period last year, and adjusted EPS increased to $0.71 compared to a loss per share of $0.29 in the same period last year.

I hope this article has been helpful and motivates you to commit to transforming your distribution business into an agile and resilient organization. I will continue to post information related to warehouse management, distribution practices and trends, and the general economy. If you are interested in this article or want to learn more about Laceup Solutions, subscribe to stay updated on future articles.

There is a lot of relevant information on our channel. Check out this video!

Sorry, the comment form is closed at this time.