A deep dive into US Foods reaction to the pandemic

A practical example of non-resilience

We recently talked about Sysco Corporation and how its resilient and agile structure allowed them to quickly recover from the effects of the COVID pandemic. In this article I will address the case of US Foods Corporation, one of Sysco´s strongest competitors but, unlike Sysco, their traditional organizational structure led them to serious problems during the pandemic.

An overview on US Foods Corporation

US Foods Corporation is one of the leading suppliers of food for more than 300,000 independently owned single and multi-unit restaurants, regional chain restaurants, national chain restaurants, hospitals, nursing homes, hotels and motels, country clubs, government and military organizations, colleges, and universities, and retail locations. They provide more than 400,000 fresh, frozen, and dry food stock-keeping units, or SKUs, as well as non-food items, sourced from approximately 6,000 suppliers. They have 70 distribution facilities and a fleet of approximately 6,500 trucks, along with nearly 80 cash and carry locations.

Their growth strategy is a mix of internal expansion of existing operations and planned acquisitions but, unlike Sysco, they manage the business as a single operating segment through standardized business processes, shared systems infrastructure, and an organizational model that optimizes national scale with local execution and their motto GREAT FOOD. MADE EASY.™. They have registered the US Foods, Food Fanatics, Chef’Store, and Smart Foodservice trademarks as part of their overall brand strategy.

In the fiscal year 2020, no single customer accounted for more than 3% of their customers’ total sales, and sales to their top 50 customers represented approximately 39% of their net sales.

| Sales Proportion | 2020 | 2019 | 2018 |

| Meats and seafood | 35.53% | 35.90% | 35.72% |

| Dry grocery products | 17.18% | 17.07% | 17.53% |

| Refrigerated and frozen grocery products | 15.66% | 16.40% | 16.12% |

| Dairy | 10.46% | 10.35% | 10.42% |

| Equipment, disposables, and supplies | 10.73% | 9.57% | 9.51% |

| Beverage products | 5.18% | 5.41% | 5.44% |

| Produce | 5.27% | 5.30% | 5.25% |

Effect of the pandemic on US Foods’s operations

Like Sysco, the global COVID-19 pandemic and its sudden and significant effects on the economy had a direct impact on US Foods customers. The widespread adoption of “social distancing” measures, government instructions to shut down non-essential businesses, and public perception of the risks associated with the COVID-19 pandemic resulted in a substantial disruption to many of their customers’ operations including the limitation of dining options and the temporary (and, in some cases, permanent) closure of many restaurants, hospitality, and education customer locations. All of this significantly reduced the demand for US Foods products and services. These are some of the KPIs:

- Total case volume was down approximately 11.0% during the 53 weeks ending January 2, 2021.

- The decrease in sales from the US operations was 10.9%; for the international operation it was 15.8% and for the entire corporation it was 12% ($7 billion).

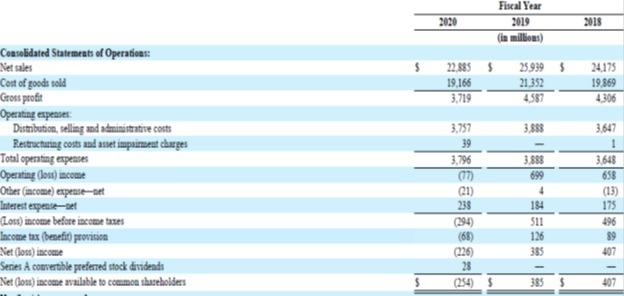

- Gross profit decreased $868 million, or 18.9%, to $3,719 million in the fiscal year 2020

- Net operating loss of $294 million

- The provision for doubtful accounts receivable increased to $47 million due to the impact of COVID-19 on its clients.

- Free cash flow decreased 55%.

- The value of the shares decreased by 21%.

.

Key re-actions taken by US Foods

Since the food industry is considered an essential service, US Foods and Sysco could continue to operate. But unlike Sysco which focused on alternative ways to generate income leveraged on its strength, in response to the COVID-19 pandemic and the ensuing decrease in overall case volume, US Foods focused on reducing the cost structure to compensate for the decrease in income. These are the key elements of their “Re-action Plan”.

- They reduced the size of their workforce by eliminating open positions and laying off approximately 5% of their employees.

- To make up for the lack of liquidity, they increased their debt structure by nearly $5 billion with a combination of accounts receivable loans, Incremental Term Loan Facilities, Secured Notes, and Unsecured Notes due in 2029. Parts of the proceedings were used to pay off critical debts.

- They released a pending acquisition, but could not do that with the Smart Foods acquisition which was completed in April 2020 and required $972 million.

- They discontinued contributions to the Company-sponsored defined benefit and other post-retirement plans which increased staff turnover.

- They developed additional innovative services, such as customer education webinars on the Coronavirus Aid and Relief and Economic Security Act (the “CARES Act”).

- They created a unique pantry kit to allow restaurants to continue servicing consumers.

As you can see, most of the actions were geared towards coping with the situation. The innovative ideas (5 and 6 above) did not have enough traction to generate sufficient income to compensate for the decrease in revenues. So, they mainly relied on the recovery of the country.

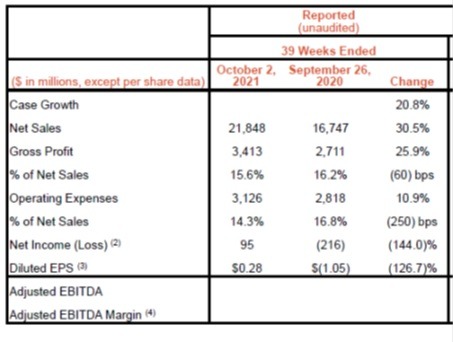

As restrictions due to COVID have been relaxed, restaurant sales have slowly increased, and with them, US Foods’ results have improved. Below are the P&L for the last three years and a report as of October 2021.

I hope this article has been helpful; I have tried to stress over and over the importance of becoming a resilient and agile structure as the only means to survive and progress in this rapidly changing world. I will continue to post information related to warehouse management, distribution practices and trends, and the economy in general. If you are interested in this article or want to learn more about Laceup Solutions, please subscribe to stay updated on future articles.

There is a lot of relevant information on our channel. Check out this video that does a comprehensive analysis of US Foods’ 10K report!

Sorry, the comment form is closed at this time.