WMS ROI: what it is and how to calculate it

Many articles have been written to highlight the benefits that a WMS brings to your warehouse operation. However, a simple statement of benefits alone might not convince the owners to invest in such a system. When this happens a WMS ROI analysis should be performed. In this article, I will talk about how to calculate a WMS ROI and how to do it.

Elements of a WMS ROI

In general terms a ROI calculation has three components:

- An investment in the system, including acquisition, implementation and maintenance over a life cycle.

- A reduction in costs associated with the implementation of the system.

- The profitability obtained by the implementation, which is a function of the saving obtained over time versus the investment.

In the next sections we will go over each one of these elements.

WMS costs estimation

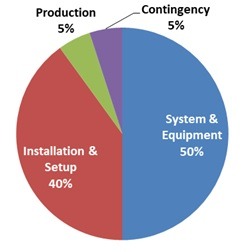

First, you need to calculate a WMS ROI, which is an estimation of the amount of money you need to commit to the project over its lifetime. Most of the capital will be dedicated to the implementation phase. These are the main elements to consider.

- Acquisition of the system and the necesary equipment.

- System installation and setup: This includes vendor support during installation, system integrations and software customization.

- Put the system in production: includes changes in procedures, warehouse layout and organization, initial data load and training.

- Contingency costs: It is always advisable to include a small percentage of the cost of the system to deal with unexpected problems during installations. In our article on “WMS Implementation at Arctica: a successful case study” we gave real examples of these type of contingencies.

In the graph below we show the average capital allocation for each of these concepts.

Once the system is up and running, you must consider maintenance costs. It is normally taken as a percentage of the cost of the system and covers the vendor’s support and the equipment maintenance.

Estimation of the benefits of a WMS

The savings derived from the benefits obtained by a good WMS can be classified into two groups:

- Tangible benefits: These are those benefits that can be quantified thrpugh KPIs. The most common are: Labor reductions (consider direct labor such as picking personnel, as well as indirect labor, such as data entry employees), expired items in stock, reduced inventory, inventory accuracy, and paperwork savings.

- Intangible Benefits: these are those benefits that we “feel” that we will obtain, but that are difficult to calculate. These include motivated employees, customer satisfaction, information availability, and overall cycle time reduction on purchases to vendors and sales order received.

Be as thorough as possible when estimating all of these savings and involve a multi-department team in the estimates. As a reference, these are some historic data gathered on the benefits that the acquisition and proper implementation of the WMS will bring to an average small and medium business.

- Picking accounts for an average of 45% of your warehouse costs: Labor costs reductions of up to 35% are not uncommon with the introduction of a WMS.

- The correct implementation of a WMS can lead up to a 27% reduction in capital inventory and carrying costs.

- 15% improvement in inventory accuracy: It is well documented that a WMS will always achieve near perfect inventory accuracy in the warehouse, when combined with the right supporting processes, like cycle counting. This translates directly into lower safety stock, accurate shipments, expired products and increased customer satisfaction.

- Up to 5% improvements in shipping errors.

Calculation of the WMS ROI

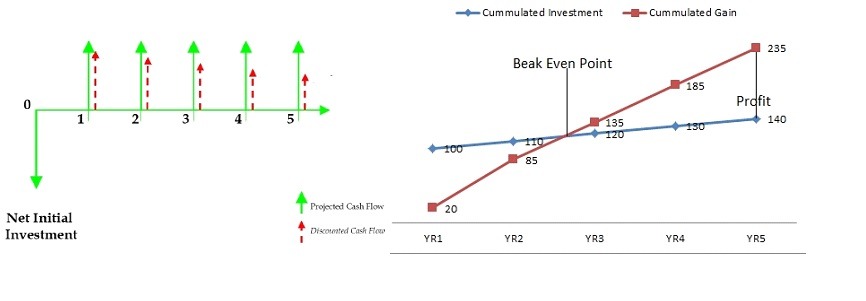

Once you have the capital required and the estimated savings to be obtained, you can estimate the WMS ROI (Internal Rate of Return) of implementing the system. If you put money in an investment account, you will receive an interest on that money. Likewise, if you invest in a system, the ROI tells you the gains that you will receive for your investment. Obviously, it must be significantly higher than a passive investment. ROI is calculated by placing a timeline the capital disbursement you will make, as well as the savings or returns you will receive. In the past, the timeline was the expected life of the system; but nowadays, with the ever changing environment, a short time line is normally considered (5 years is very common).

There are different methods for calculating the ROI. The most commonly used are calculated as follows:

ROI based on investment:

- Subtract the initial cost of the investment from its final value.

- Divide this result by the cost of the investment.

- Multiply it by 100.

ROI based on Net Present Value (NPV):

- Subtract the saving from capital expenditures for every year, in order to determine the net cash flow for every year.

- Since the acquisitive power of the money varies every year, we want to “adjust” the net cash flow of every year to reflect its real value in the present time (NPV). You do that by “discounting” the all expected future cash flows to the present time, using the required corporate rate of return.

- Add the adjusted cash flow.

The graphs below illustrate the way to represent ROI for each method.

I hope this article has been helpful to you. I will continue to post information related to warehouse management, distribution practices and trends, and the economy in general. If you are interested in this article or want to learn more about Laceup Solutions, please subscribe to stay updated on future articles.

There is a lot of relevant information on our channel. Check out this video on cycle count.

Sorry, the comment form is closed at this time.