Why is the DSD Distribution Still Working in 2023?

Since the 1980s increased competition has forced retailers to focus on lowering inventory management costs throughout the supply chain. In this context, the DSD distribution was considered a valid model for retailers to increase sales while reducing inventory holding costs. However, the 2020 pandemic and its aftermath changed consumer buying habits, challenging retailers and the entire supply chain, to review the way products are delivered from the factory to consumers. This situation raises the question of whether the DSD distribution is still a valid model. In this article I will address this issue.

What is a DSD distribution company?

DSD (Direct store delivery) distribution means delivering products from a supplier or distributor directly to a store, without going through the retailer’s distribution center. DSD companies usually offer additional services as a way to stand out from the competition. Such as:

- In-store Merchandising

- Store Ordering

- Shelf Inventory Management

- Price and Promotion Execution

- In-store Forecasting

Distribution models

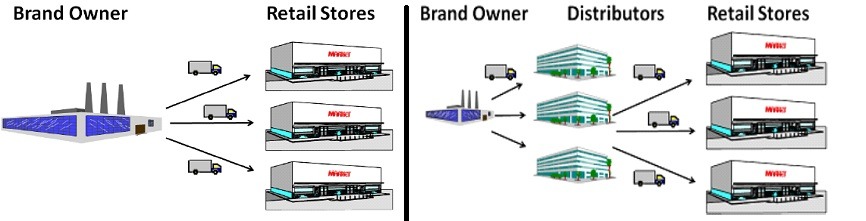

There are two DSD distribution models:

2 tier DSD: The product goes from the manufacturer or brand owner to the retailer.

3 tier DSD: Product goes from manufacturer to a distributor and from there to the retailer.

The figure illustrates the two models.

Changes in distribution models since 2020

Here are some statistics from the Direct Store Delivery Organization to illustrate the relevance of the DSD as of 2020.

- DSD suppliers labor contribution from represents 25% of the total store orkforce in the North American market.

- DSD products represent 24% of unit volume sold in a store.

- DSD products represent up to 52% of the contribution margin of store sales.

- 62% of the new products launched were brought to the market using DSD processes.

- Seven of the top ten largest grocery categories (by unit sales volume) are handled through DSD processes (beer, carbonated beverages, fresh produce, milk, salty snacks, bread and baked snacks, frozen).

The COVID-19 pandemic changed consumer behavior in several ways as shown below courtesy of CGT.

Under these circumstances retailers and manufacturers are reducing delivery time and costs through pickup sales and online sales. Does this mean the death of the DSD distribution companies? Quite the contrary, as we will explain in the next section.

Why the DSD Distribution model still works in 2023

As described in “What is the best way to get your product in stores?” there are 7 categories of retailers:

Conventional supermarkets are basic community supermarkets that offer a variety of foods and produce, canned goods and meat, and a smaller, less robust number of non-food items, such as school supplies or over-the-counter medicines.

Limited Assortment Supermarkets, which offer food products, but in reduced volume and at a lower price.

Independent Stores have a supply of food products offering similar to Supermarkets, but at a lower price than Limited Assortment Stores.

Supercenters, which combine a full-size grocery store or supermarket with full-sized general merchandise all under one roof.

Warehouse clubs are large bulk grocery stores that require membership.

Convenience stores are small grab-and-go establishments that you can find on the corner in many neighborhoods.

As explained in “How to overcome the Distribution challenges in this new age?” all retailers were affected by the changes since 2020 and in turn, the DSD and distribution industry were also affected. The greatest reduction in the use of DSD services has been seen in the big retailers and conventional supermarkets. However, convenience stores and independent retailers, typically served with the 2-tiers DSD model, have not and will not reduce the use of DSD services for five reasons:

- Store space

- High rotation

- Limited shelf space

- Limited personnel to shelve products

- Little time to do merchandising

Even though DSD services in retail stores have decreased, the distribution of perishable products such as meat, seafood, poultry, dairy products, fruits and vegetables, has not been significantly affected due to the high cost of inventory carrying of these products.

In summary, DSD distribution is here to stay and will continue to be a viable business, as long as optimization actions and strategies reviews are carried out to adapt to these changing times. I will be talking about that in a future article.

I hope this article has been helpful to you. I will continue to post information related to warehouse management, distribution practices and trends, and the economy in general. If you are interested in this article or want to learn more about Laceup Solutions, please subscribe to stay updated on future articles.

There is a lot of relevant information on our channel. Check out this video related to the subject.

Sorry, the comment form is closed at this time.