Consumer packed goods sales & delivery strategy

Manufacturers or producers of consumer packed goods have many options for getting their products to the end user. Each option involves an additional link in the supply chain, but the main goal is to get products from production to consumer as efficiently and profitably as possible. In this article, I will review the different sales and delivery methods and the pros and cons of each.

What are consumer packed goods?

Consumer packed goods (CPGs) are products that consumers use daily and buy frequently, like food, beverages, and cleaning products. Consumers normally buy these types of products at retail stores; so it is very important that manufacturers or brand owners ensure the permanent availability of these products on store shelves.

With the highest rate of inflation since 1990, food prices rising 9.4% (the biggest jump since 1981), fuel and energy prices higher than ever, and ongoing labor shortages, packed consumer goods brands are striving to improve efficiency and cut costs. Under this scenario, the speed and associated cost of keeping key products on store shelves become very important.

CPG sales and delivery models

There are two basic sales models that a manufacturer or importer of consumer packed goods has:

- Sale to the central warehouse of the stores

- Sale directly to stores as a DSD model

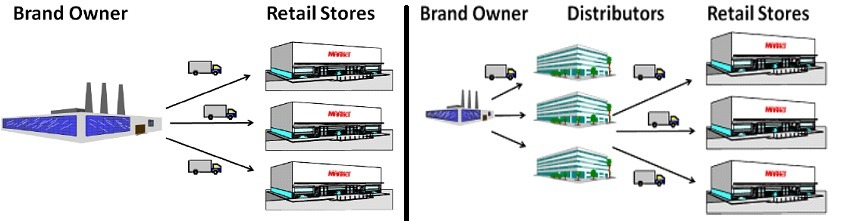

The figure below illustrates these two models.

However, since the COVID pandemic, several brands opted to open a third option: adding an ecommerce channel to sell directly to consumers, as a response to the collective fear of leaving home. Even though fear has subsided, many companies have kept this channel open. In the reminder of this article, I will review the two main options: central warehouse vs DSD sales.

Central warehouse delivery

Retail chains with stores in vast geographical areas, such as Walmart and Publix, have multiple central warehouses where they store high-volume products. They consolidate the sales volume of all the stores within the perimeter, buy them from the suppliers, and then deliver them to the stores. For the retailer, the main advantage of this modality is the lower cost of the product: when buying in volume, they negotiate better prices and conditions. The main disadvantage is that the logistics costs increase since they have to take care of the delivery to the stores.

For the brand:

- The main advantage is that they simplify logistics by delivering to a single point, which reduces logistics and operating expenses.

- The main drawback is that the sale price is lower and therefore the gross profit.

- Since the delivery time to the stores is longer, the main risk is that the presence of the product could be affected in a large number of stores if there is a logistical problem in a central warehouse.

Direct store delivery method

In a DSD method, the product is delivered to each store directly and not through the retailer’s distribution centers. There are two ways the manufacturer or importer can do this:

- They sell to the store and take care of the delivery in each store.

- They sell to a distributor who, in turn, takes care of the sale and delivery to the stores.

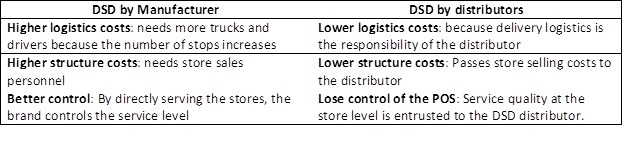

Below is a summary of the effects of each method on the manufacturer or importer.

Centralized delivery vs. DSD

Which method should the manufacturer use? This is the key question, and the answer depends on several factors. The main ones are:

- Size of your portfolio: if you produce a few items, the cost associated with having your DSD structure will probably exceed the tolerable margin.

- Type of products: certain products, like frozen products or temperature-controlled products, require certain storage conditions that the central warehouse might not have.

- Shelf life of products: many food products have a short expiration date. For such goods, the additional delivery time associated with the 2 tiers of a central distribution center model may not be acceptable.

- Seasonality: Some consumer packed goods have special peaks during some months. Meeting demand during peak season requires additional structure that will be prohibitively expensive for most DSD manufacturers. A DSD distributor, by contrast, has enough products to have larger structures that allow fast response to changes in demand.

- Size and strength of competing brands: Given the nature of consumer packed goods, competition is often brutal both in number of players and in sales aggressiveness. To stay on top of the market, the promotion strategy in stores must be very dynamic. Most stores and DSD manufacturers do not have this capability.

If your consumer packed goods fall into more than 3 of these factors, your best bet is to have an alliance with a good DSD distributor, reinforced by suitable KPIs.

I hope this article on warehouse digital transformation has been helpful to you. I will continue to post information related to warehouse management, distribution practices and trends, and the economy in general. If you are interested in this article or want to learn more about Laceup Solutions, please subscribe to stay updated on future articles.

There is a lot of relevant information on our channel. Check it out this video related to this topic.

Sorry, the comment form is closed at this time.