2026 Distribution Planning in the US: Distributors Scenarios and Strategic Responses

As the U.S. distribution landscape moves toward 2026, planning can no longer rely on linear growth assumptions or short-term forecasting. Distributors face an environment shaped by economic uncertainty, labor constraints, accelerating technology adoption, regulatory pressure, and changing retail and consumer expectations. 2026 distribution planning requires scenario-based thinking, operational flexibility, and investments that balance resilience with profitability. In this article, I outline the most likely scenarios distributors should prepare for, and the strategies that will separate leaders from laggards.

Why Distribution Planning Looks Different in 2026

Uncertainty defines 2026, with trade policies, economic cycles, and climate events creating multiple pathways. Several structural shifts are now permanent realities:

- Volatile demand cycles driven by inflation sensitivity and Geopolitical changes

- Continued labor shortages in warehousing, driving, and merchandising

- Retailers are pushing more operational responsibility upstream to distributors

- Faster compliance timelines (food traceability, data accuracy, ESG reporting)

- Heightened expectations for service levels, visibility, and responsiveness

The distributors who succeed in 2026 will be those who plan for multiple futures rather than betting on one.

Potential Scenarios for 2026 Distribution Planning

Below, we outline three plausible scenarios based on current forecasts, each with implications for distribution planning.

Scenario 1: Tariff Turbulence and Reshoring Boom (High Probability: 60%)

In this baseline outlook, the Trump administration’s tariffs—potentially 15-30% on imports from China and allies—escalate, spurring onshoring and nearshoring. Major tech firms like Apple and Tesla announce further US manufacturing expansions, but consumer prices rise 5-10%, dampening demand. Freight recession lingers until Q2, with intermodal volumes dipping due to border delays. Distribution Impacts:

- Warehouse demand spikes in the Midwest and Southwest, but power shortages in hubs like the San Francisco Bay Area limit automation rollouts.

- Inventory costs surge 20% due to elevated storage and insurance, per the Logistics Manager Index.

- Last-mile delivery faces 12% labor shortages, pushing reliance on gig models.

Scenario 2: AI-Driven Efficiency Surge (Medium Probability: 30%)

Optimistic growth materializes as AI adoption hits 80% of enterprises, enabling autonomous decision-making in routing and forecasting. E-commerce rebounds with stable inflation (2-3%), and de minimis trade rules evolve to favor blended onshore-sea strategies. Global trade grows modestly, but US onshoring stabilizes supply. Distribution Impacts:

- Utilization reaches 90% in modern facilities, driving net new leases and rent growth in secondary markets like Indianapolis.

- Automation cuts picking times by 35%, but cybersecurity threats rise, with 40% of firms reporting breaches.

- Sustainable procurement boosts, with 50% of fleets electric, reducing emissions, but straining grid infrastructure.

Scenario 3: Geopolitical Stagnation and Cost Crunch (Low Probability: 10%)

Escalating conflicts (e.g., Panama Canal disruptions) and inflation spikes to 4-5% trigger a freight downturn, with slack demand and oversupply in warehousing (vacancy >10%). Tariffs fizzle amid negotiations, but labor strikes and container imbalances add 15% to repositioning costs.

Distribution Impacts:

- Oversupply pressures pricing, with the Producer Price Index for warehousing dropping 5%, but rising labor costs erode margins.

- Demand variability leads to 20% more stockouts, favoring diversified suppliers over single-region reliance.

- Climate events disrupt 10% of routes, underscoring the need for antifragile designs like multimodal backups.

These scenarios highlight the need for flexible planning, where base cases incorporate tariff buffers and upside leverages AI for agility.

Core Planning Principles for 2026 Distribution Planning

Regardless of which scenario dominates, successful distributors will share these traits:

- Flexible infrastructure: warehouses, routes, and labor models that adapt quickly

- Execution visibility: real-time insight from dock to shelf

- Disciplined service design: matching service levels to profitability

- Technology with purpose: every system tied to measurable outcomes

- Scenario-based leadership: planning for uncertainty, not hoping it disappears

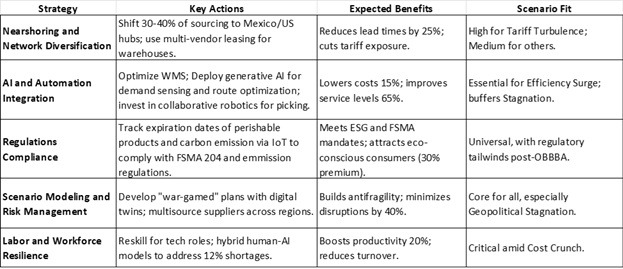

To thrive across scenarios, US firms should prioritize 2026 Distribution planning strategies that blend technology, diversification, and sustainability. Here’s a framework with tactical recommendations:

Conclusion

2026 Distribution planning is less about predicting the future and more about preparing to shape it. Whether facing tariff headwinds or AI tailwinds, US companies that invest in diversified, tech-forward networks will outpace competitors.

At LaceUp Solutions, we explore how technology transforms distribution, from warehouse management and route optimization to digital sales enablement. Subscribe to the LaceUp Blog for weekly insights on wholesale growth, innovation, and the future of logistics. For more information, please get in touch with us to learn about our solutions.

I hope this article on 2026 Distribution planning have been helpful. I will continue to post information related to management, distribution practices and trends, and the economy in general. Our channel has a lot of relevant information. Check out this video on Inflation.

Sorry, the comment form is closed at this time.