Impact of Monetary Policy and Interest Rate on Distribution Financing

In previous articles, we have analyzed the impact of government policies on a distribution operation. One crucial factor considered was monetary policy, mainly through the mechanism of interest rate adjustments. Distribution companies, which rely heavily on financing for infrastructure development and inventory investment, are susceptible to fluctuations in interest rates. In this article, I will focus on distribution financing and how changes in interest rates, driven by central bank policies, influence the cost of distribution financing and the strategic decisions distribution companies must make.

The Role of Interest Rates in Distribution Financing

Interest rates determine the cost of borrowing. When central banks raise rates to combat inflation or cool down an overheated economy, borrowing becomes more expensive. Conversely, lower interest rates, often implemented to stimulate growth, reduce the cost of loans and financing. For distribution companies, which typically operate on thin margins and depend on financing to manage cash flow, any significant change in interest rates can have profound effects on their operations.

Infrastructure Investment and distribution financing

Cost of Expansion and Upgrades: Distribution companies often invest in warehouses, transportation fleets, and technological systems. These capital-intensive projects frequently require long-term financing. When interest rates rise, the cost of financing these projects increases, which can deter or delay infrastructure expansion or upgrades. Companies might reconsider large projects or scale down investments to maintain profitability.

Lower interest rates, on the other hand, reduce the cost of borrowing, making it more attractive for distribution companies to pursue infrastructure investments. In times of lower rates, companies can afford to modernize facilities, adopt new technologies, or expand their geographic footprint, all of which are essential to staying competitive in a rapidly evolving marketplace.

Impact on Leasing vs. Buying: Many distribution companies also face decisions between leasing and buying infrastructure such as trucks, storage facilities, or advanced equipment. Higher interest rates typically lead to an increase in leasing costs, as leasing companies pass on higher borrowing costs to their clients. As a result, the decision to lease becomes less financially attractive compared to ownership, prompting companies to weigh long-term purchasing options.

Inventory Investment and Cash Flow in distribution financing

Inventory Financing: Maintaining adequate inventory is crucial for distribution companies to meet demand. However, inventory investment often requires short-term financing, particularly during peak seasons or when expanding product lines. When interest rates rise, the cost of securing financing for inventory increases, leading to higher operational costs. In response, companies may reduce inventory levels or optimize supply chain efficiency to minimize the need for large upfront capital.

Conversely, when interest rates are low, companies have greater flexibility in stocking up on inventory, potentially leading to bulk purchasing advantages or the ability to respond more rapidly to shifts in demand. Lower financing costs allow distributors to maintain a buffer of stock without excessive financial strain, contributing to smoother operations and customer satisfaction.

Working Capital and Operational Costs: Distribution companies rely on short-term credit and loans to finance day-to-day operations. Higher interest rates increase the cost of this working capital, squeezing cash flow. For distributors, this often translates to tighter budgets for payroll, marketing, or technological investments. Companies may need to renegotiate payment terms with suppliers or customers to preserve liquidity in a high-interest environment.

In periods of low interest rates, working capital is more affordable, providing greater operational flexibility. Companies can invest in efficiency-improving technologies, increase workforce training, or expand services without the burden of high borrowing costs.

Strategic Adjustments to Interest Rate Fluctuations

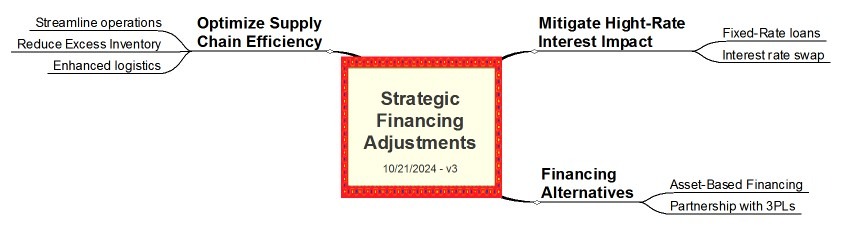

Hedging Against Rate Increases: Distribution companies can adopt strategies to mitigate the impact of rising interest rates. Hedging through interest rate swaps or fixed-rate loans allows companies to lock in borrowing costs before rates increase. These strategies provide certainty and stability in financial planning, particularly for large-scale infrastructure projects or long-term inventory financing.

Optimizing Supply Chain Efficiency: High-interest rate environments often push distribution companies to optimize their supply chains. By streamlining operations, reducing excess inventory, and enhancing logistical coordination, companies can reduce the need for external financing. Automation, real-time inventory management, and improved forecasting tools are increasingly essential in mitigating the higher costs associated with borrowing.

Evaluating Financing Alternatives: Companies may also explore alternative financing options to traditional loans, such as asset-based financing or partnerships with third-party logistics providers (3PLs). These alternatives can help distribute the financial burden while still supporting growth and operational needs, especially when traditional borrowing becomes cost-prohibitive.

The graphic summarizes the strategies.

Conclusion

Changes in interest rates, driven by central bank monetary policies, have significant implications for the distribution industry. As the cost of borrowing rises, distribution companies face challenges in financing infrastructure projects and maintaining inventory levels, necessitating strategic adjustments in their operations. Conversely, periods of low interest rates provide opportunities for expansion and greater financial flexibility. For distribution companies, staying informed about interest rate trends and proactively managing their financing strategies is essential to maintaining competitive advantage in an ever-changing economic landscape.

Laceup Solutions’ suite of products can give you plenty of information to decide the best startegiesIf you want to learn more, give us your information to schedule a meeting.

I hope this article on the implications of monetary policy and interest rates on distribution financing has been helpful to you. I will continue to post information related to warehouse management, distribution practices and trends, and the economy in general. Our channel has a lot of relevant information. Check out this video about inflation and profits.

Sorry, the comment form is closed at this time.