Inventory Valuation: Its Importance and how to calculate it

Every business dealing in physical goods must ascertain the worth of its inventory for accounting reasons. As inventory often constitutes a substantial portion of a company’s assets, the method used to determine its value can have a substantial impact on the company’s earnings, tax responsibilities, and overall asset valuation. In this article, I address why inventory valuation is important and the most common valuation methods.

What is Inventory Valuation and why it is important

Inventory valuation is the process of assigning a monetary value to a company’s inventory, which includes the goods, raw materials, and work-in-progress items that a business holds for the purpose of resale or production. Inventory calculation is crucial for several reasons, and its importance lies in its impact on financial reporting, tax obligations, decision-making and overall business operations. Here are some key reasons why inventory valuation is needed and why it is important:

Accurate Financial Reporting: Inventory is a significant asset for many businesses, and its valuation directly affects the balance sheet. Proper valuation ensures that financial statements, such as the income statement and balance sheet, accurately reflect the company’s financial position. This, in turn, enhances transparency and trust among investors, creditors, and stakeholders.

Determining Cost of Goods Sold (COGS): Valuation of the inventory is essential for calculating the cost of goods sold (COGS), a critical component of the income statement. Accurate COGS figures are crucial for determining gross profit margins and, consequently, overall profitability.

Tax Compliance and Liability: Many tax authorities require businesses to report their income and calculate taxes based on the way they value the inventory. Choosing the right valuation method can have a significant impact on tax liabilities.

Effective Decision-Making: The value of the inventory provides insights into the value of assets tied up in inventory. This information is vital for making informed decisions regarding inventory management, production planning, purchasing, pricing strategies, and investment in new products or markets. An accurate valuation helps optimize working capital and cash flow.

Loan and Credit Eligibility: Accurate inventory value is often a requirement when applying for loans or lines of credit. Lenders use inventory values as collateral and inaccurate valuations can affect a company’s borrowing capacity and terms.

Inventory Valuation Methods

There are a number of different methods that companies can use. The most common methods are:

- FIFO: This method assumes that the first items that are purchased are the first items that are sold. This means that the cost of goods sold (COGS) is calculated using the cost of the oldest items in inventory.

- LIFO: This method assumes that the last items that are purchased are the first items that are sold. This means that the COGS is calculated using the cost of the newest items in inventory.

- Weighted average cost (WAC): This method assigns an average cost to all of the items in inventory. The WAC is calculated by dividing the total cost of inventory by the total number of units of inventory.

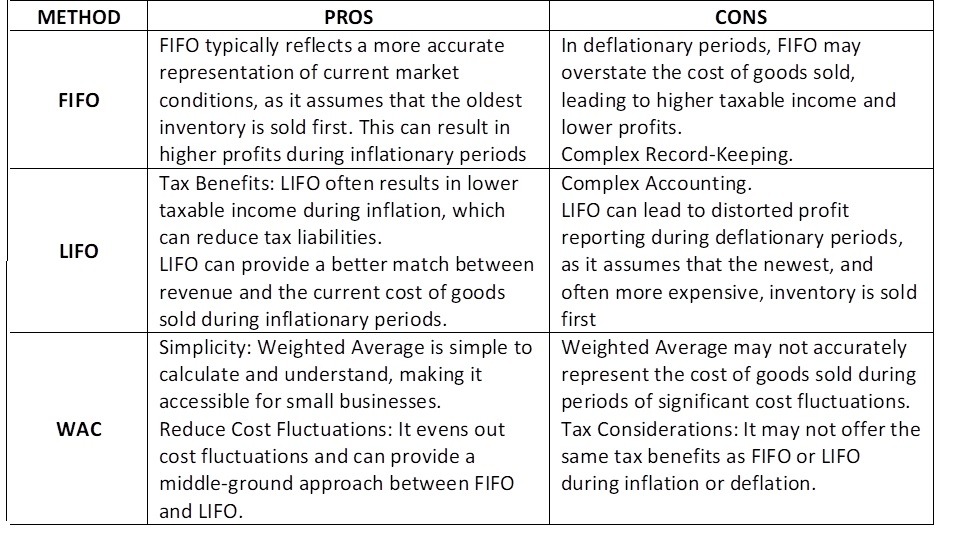

The table summarizes the pros and cons of each method.

Choosing the Right Method

As you may see, the choice of the method to value the inventory depends on various factors:

- Industry: Some industries may have specific requirements or preferential methods due to their inventory characteristics.

- Tax Implications: Consider the tax impact of each method and how it aligns with your tax strategy.

- Cost Fluctuations: Evaluate the stability of your inventory costs. FIFO may be more suitable during inflation, while LIFO may be preferable during deflation.

- Record-Keeping Capability: Assess your business’s capacity for managing complex accounting methods.

- Accuracy: Choose a method that best represents your business’s financial reality.

Laceup and Inventory Solutions

LaceUp Solutions WMS supports all three major inventory valuation methods, so businesses can choose the method that best suits their needs. It also has other features like Real-time inventory tracking, Lot and serial number tracking, and Inventory forecasting, which can help businesses of all sizes improve their inventory management practices and achieve their financial goals. If you are interested in learning more, click the link and we will call you.

I hope this article has been helpful to you. I will continue to post information related to warehouse management, distribution practices and trends, and the economy in general.

There is a lot of relevant information on our channel. Check this video about FIFO.

Sorry, the comment form is closed at this time.