Understanding Inventory Turnover Ratio and the Role of a WMS in optimizing it

Inventory management is crucial for any business, impacting financial health, customer satisfaction, and operational efficiency. In this article, I explain what inventory turnover ratio is, how to calculate and interpret it, their significance for businesses, and how a Warehouse Management System (WMS) can assist in optimizing these ratios.

What is an Inventory Turnover Ratio?

Inventory turnover or stock turnover, is a financial metric used to evaluate how efficiently a company manages its inventory. It measures how many times a business can sell and replace its inventory during a specific period, typically a year. A higher turnover ratio generally indicates that a company is efficiently managing its inventory, while a lower ratio may suggest inefficiency or overstocking.

How to Calculate Inventory Turnover Ratios

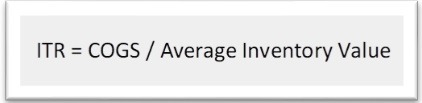

The formula for calculating inventory turnover ratio (ITR) is:

Where:

Cost of Goods Sold (COGS) is the total cost of the goods that a company sold during a specific period. It includes the cost of production, purchase, or acquisition of inventory.

Average Inventory Value is the average value of inventory held by the company during the same period. To calculate this, you can add the beginning inventory value and ending inventory value for the period and divide by 2.

Interpreting Inventory Turnover Ratios

The ideal ITR varies depending on the industry and business model. However, the common practice is to aim for an inventory turnover ratio higher than industry standards. For instance, the average ITR for the grocery industry is 15, while the average for the automotive industry is 5. In general terms:

In Efficient Operations a high inventory turnover ratio indicates that a company is quickly selling and replenishing its stock, which can lead to reduced carrying costs and increased cash flow.

Low Ratios may signal overstocking or slow-moving inventory, which can tie up valuable capital and storage space, resulting in obsolescence or increased holding costs.

While a high inventory turnover is generally positive, excessively high ratios may suggest stockouts or missed sales opportunities. Striking the right balance is crucial.

The Role of a Warehouse Management System (WMS)

A warehouse management system (WMS) plays a critical role in optimizing the inventory turnover by streamlining inventory management processes and enhancing visibility into inventory levels. A WMS provides real-time data on inventory movements, enabling businesses to make informed decisions about stock replenishment and avoid stockouts or excess inventory. Key features of a WMS that contribute to inventory turnover optimization include:

- Inventory tracking and management: WMS tracks inventory throughout the supply chain, from receiving to shipping, providing accurate and real-time inventory data.

- Demand forecasting: WMS utilizes historical sales data and market trends to forecast future demand, allowing businesses to anticipate inventory needs and optimize stock levels.

- Automated replenishment: WMS automates replenishment processes, ensuring that inventory levels are maintained at optimal levels, minimizing stockouts and overstocking.

- Optimizing warehouse layout and picking strategies: WMS helps optimize warehouse layouts and picking strategies, reducing picking times and improving overall operational efficiency.

Laceup and Inventory Optimization

LaceUp Solutions WMS can help optimize inventory ratios in a number of ways, including: Providing real-time inventory visibility, optimizing picking and packing processes, reducing inventory shrinkage, and improving forecasting accuracy. If you are interested in learning more, click the link, and we will call you.

I hope this article has been helpful to you. I will continue to post information related to warehouse management, distribution practices and trends, and the economy in general.

There is a lot of relevant information on our channel. Check this video about inventory accuracy.

Sorry, the comment form is closed at this time.