7 tips to optimize your wholesale product portfolio

The product portfolio is a key element for a successful distribution operation. For this reason distributors are constantly looking for new products to expand its product offering. However, a large portfolio can also add costs and complexity to the business, reducing margins and overall profitability. In “9 tips to select new products for your distribution business” I provided a guide to select what products to add to the portfolio. In this article I will address when you should review your product portfolio, how to evaluate it and how to optimize it.

When is time to review the product portfolio?

The performance of product lines in a distribution operation depends not only of the products themselves but also on many operating variables, like sales force, warehouse efficiency, marketing strategies and cash flow among others. But independent of the cause the most important issue is to be aware of the symptoms that point toward performance problems in your product portfolio. Here are some of the most common ones:

- Number of orders handling exceeds the available resources in the warehouse

- High costs in the handling of small orders

- Warehouse is approaching its maximum capacity or is starting to overflow

- Products are expiring in the stores and the warehouse

- Stores are complaining for order delays

- Cash flow is decreasing in spite that sales are steady

All you need to monitor these variables is an adequate set of Key Performance Indexes (KPI’s) like the ones mentioned in “Improve your efficiency with the right Distribution KPIs”. Whenever negative KPI’s associated to these situations start becoming the everyday instead of the exemptions, it is time to evaluate the product portfolio.

How to evaluate the product portfolio?

As hinted above a portfolio evaluation is intended, not only as a tool for portfolio optimization, but also to pinpoint and address operational problems. The evaluation of a product portfolio falls in the realm of what is known as “Product Portfolio Management (PPM)”, which is the practice designed to manage all aspects of the products and services that a company sells. The idea started in the late 60’s when the Boston Consulting Group developed his BCG matrix to classify products in four categories. Later in the 70’s McKinsey Group developed his GE–McKinsey nine-box framework, which provided a view on how attractive a category or industry is and how strong the different product lines are.

There is a plethora of PPM software, many of them very expensive. But in my experience for a regular small to medium distributor all they need is:

- A good Warehouse Management System

- A Route Management software

- An ERP or accounting system

7 steps to optimize your product portfolio

Step 1: Build your product portfolio matrix

You can do that with a spreadsheet exported from your ERP or WMS system with this basic information:

Step 2: Define your priorities

The best products are those who have a top contribution to sale, gross margin, and vendor/payment ratio (financial cycle; but in order to rank them you need to define the importance of each of them. In general, the cash that a product generates is the most important factor. But every distributor have their specific parameters; so, they must define the weight of each of these element.

Step 3: Rank the products

Rank the importance of your products based on the matrix and the priorities above. The ranking will be a non-linear combination of the last five columns of the matrix.). For example, a product that has a good contribution to sales but has a low gross profit and/or negative financial cycle (meaning that you have to pay before you sale and collect) will probably rank low.

Step 4: Build a Ranking Matrix

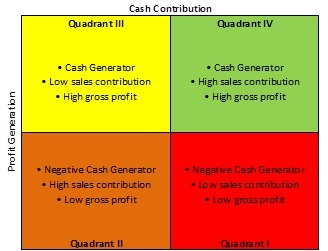

Build a 2×2 matrix in the line of the BCC and based on your priorities. The example below prioritizes the contribution to the cash flow and gross profit.

Step 5: Weigh each quadrant

In theory the importance of a product to the portfolio goes from quadrant I (negative contribution) to quadrant IV (best products). However, this classification might be misleading if we do not consider each product in his overall context. For example:

- A product might be in quadrant I because it is a new product but it has good potential.

- Or you can have a product in quadrant II that belong to a category with several products in categories II or IV that leverage on that product.

- Or a product in quadrants III or IV might be at the end of its life cycle and will start waning.

So, the next step is to evaluate each product considering its life cycle and category.

Step 6: Build an action matrix

Rebuild the matric in Step 4 restructured with the analysis in Step 5, with the recommended action plan.

Step 7: Define an action plan

Define the action plan for each of the quadrants in the Step matrix leading to the optimization of the portfolio.

I hope this article has been helpful. I will continue to post information related to Warehouse Management, distribution practices and trends, and the general economy. If you are interested in this article or would like to learn more about LaceUp Solutions, please sign up to stay updated on future articles.

Sign up for the LaceUp Blog

There is a lot of relevant information on our channel. Take a look at this video!

Sorry, the comment form is closed at this time.